Unlock the publisher's digest free

Roula Khalaf, editor -in -chief of the FT, selects her favorite stories in this weekly newsletter.

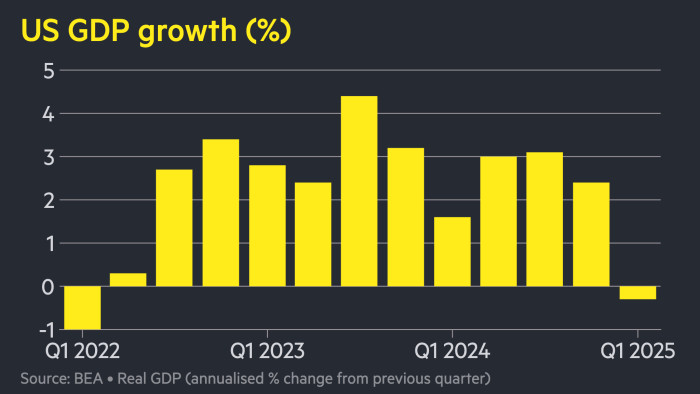

The American economy was contracted by a 0.3% annualized during the first quarter, while companies in the largest economy in the world reacted to the Donald Trump trade war by rushing towards the importation of goods.

The drop in GDP for the period was worse than the most recent forecasts for economists and compared to the rate of 2.4% recorded for the fourth quarter.

The figure has marked the first time since 2022 that reading the GDP of the greatest economy in the world has decreased.

The fall was largely the result of the precipitation of American companies to buy goods abroad before Trump's radical pricesWith data from the American census office on Tuesday showing the commercial deficit of goods reaching a record in March.

In an article on his Truth social network, Trump suggested that the figures had “nothing to do with the prices”.

Blame the former president Joe Biden, he added: “I did not take over before January 20 … When the boom starts, it will be like no other. Be patient !!!”

The difference between imports and exports is an important factor in the calculation of GDP, which also measures domestic consumption, investment and public spending.

Gregory Daco, chief economist, Ey-Parthenon, said that the “frontage of business orders to get ahead of the prices” had “created a massive shock for GDP”.

But Daco described the factors of Wednesday GDP figure as “unprecedented distortions” which were unlikely to change the calculations of the Federal Reserve on the underlying performance of the American economy.

Although the commercial deficit of the goods has led to the bass of the overall GDP for the quarter, this was partly offset by the companies that spend for storage.

The stock -up contracts have dropped and bond yields increased slightly by following the data. The two -year treasure yield, which moves with interest rates expectations, increased by 0.01 percentage points to 3.66%.

There was no significant change in expectations to lower interest rates after data, traders on the long -term market are still on the stock market of approximately four reductions this year.

Several Wall Street economists have revised their estimates for the growth of the first quarter of the first quarter after the publication of the trade in the goods on Tuesday.

The Bureau of Economic Analysis, which produced Wednesday GDP figures, added that the drop in production for the first quarter also reflected a drop in public spending.

In a recognition of the storage which took place before the announcement of Trump's prices this month, the office underlined the increase in “the investment of private stocks”.

He added that consumer spending was also among the factors which, in part, but not entirely, compensate for the increase in imports and the decline in public spending.

“The strong figures for domestic demand are a poignant recall of what could have been a graceful mild landing until the radical prices launched the off -course economy,” said Eswar Prasad, professor at Cornell University.

Trump's trade war is expected to lead to slower growth during the second half of this year, with higher prices weighing on consumption.

The IMF said last week that American GDP would extend by 1.8% this year – down compared to its January 2.7% estimate. Many private sector forecasters do not predict any growth at all.