Unlock the White House Watch watch newsletter for free

Your guide on what Trump's second term for Washington, Business and the World means

American actions jumped Wednesday after Donald Trump said he did not intend to dismiss the president of the federal reserve Jay Powell, raising concerns about the independence of the American Central Bank which had shaken the markets this week.

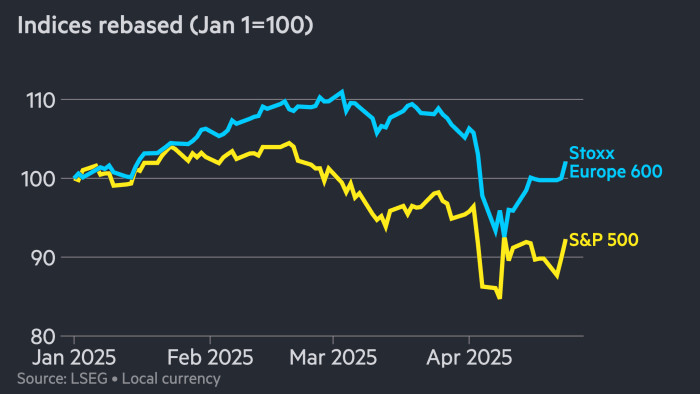

The S&P 500 climbed 3.2% in the morning trade, while US Treasury bills and Europe actions also made strong gains.

The movements were built on Tuesday rebounded for the reference to Wall Street, which increased by 2.5% while Trump indicated a potential relaxation of trade tensions with Beijing, saying that the prices on Chinese products “would decrease considerably”.

The president also reiterated his frequent complaint that the Fed needed to reduce loan costs, but added: “I do not want to talk about it because I have no intention to dismiss (Powell).”

“The markets will welcome his vote of trust (drying), but damage to the independence of the Fed have been caused,” said Dario Perkins, of the TS Lombard, in a note to customers. “Trump wants rate drops, but his vicious attacks against Powell have made more difficult for the central bank to deliver.”

The Broad Stoxx Europe 600 index increased by 2% on Wednesday, and the German Dax index extended recent gains with an increase of 3.2%.

The 10-year-old American treasury yield dropped 0.06 percentage points to 4.33%, continuing a recent drop after a sharp increase earlier this month. Bond yields come opposite prices.

The US dollar has won 0.5% against a basket of peers, although the currency continues to hover around several years having dropped by more than 8% this year.

Wednesday’s movements come after a volatile month for the financial markets after the announcements of Trump's so-called “Liberation Day” sparked a strong collapse of American actions. The S&P 500 remains more than 7% less so far this year despite the rebound this week.

Technological actions have been even harder, the NASDAQ composite index losing more than 12% since the start of the year. The Nasdaq climbed 4.2% on Wednesday.

The markets were also shaken last week after Trump, who was a persistent critic of Powell, said that he thought he could reject the president of the Fed before the end of his mandate in May 2026.

Salman Ahmed, world leader in the allocation of macro and strategic assets at Fidelity International, described the confrontation between the White House and the Fed as “a manifestation of a fundamental tension” in the economy.

He said that Trump's pricing policies “exerted pressure on Fed's double mandate” by increasing inflationary pressures while injuring growth.

“This tension will not fundamentally disappear as long as we do not know where the prices will settle,” said Ahmed. “The daily information flow will lead to high volatility.”

Additional reports by Ray Douglas