Unlock the White House Watch watch newsletter for free

Your guide on what the US elections of 2024 mean for Washington and Le Monde

Six months ago, the manufacturer of NVIDIA fleas embodied what investors loved in the American economy: he had high profits, an impressive innovation and a charismatic founder – leather jacket – Jensen Huang.

Now, however, the company has inadvertently become a symbol of commercial nightmares unleashed by American president Donald Trump.

Wednesday, NVIDIA AVERED An imminent profit of $ 5.5 billion in new American export restrictions on sales of its fleas to China.

Huang rushed to China, in order to save his agreements. But Congress has unleashed a probe. So – without surprise – The course of NVIDIA stocks has dropped, as well as other technological companies, because investors digest an unpleasant truth: Nvidia misfortunes are only a small (very visible) sign of a much wider wave of imminent technological disturbance of Trump's trade wars.

There are at least three big lessons here. The first is that our modern political economy is haunted by a cultural dissonance. In our daily life, we tend to act and think as if the digital platforms on which we depend exist in a disembodied sphere and without border.

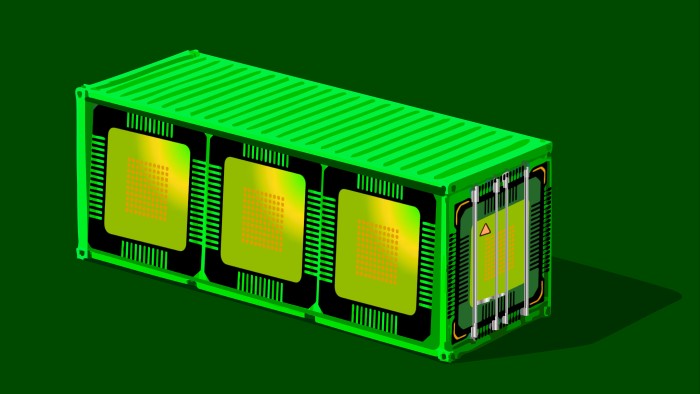

In fact, the cyber -space is based on the physical infrastructure that we tend to ignore – and the “most complicated (never seen) supply chains in human history”, as Chris Miller, a tufts, a soldier and security, said Conference at Vanderbilt University Last week.

These supply chains are going through so many borders that “person (country) is autonomous – not even close,” added Miller, noting that if Japan dominates the brochure activity (with a market share of 56%), the United States has a share of 96% in electronic design software and Taiwan controls more than 95% of advanced chips. Meanwhile, China treats more than 90% of many minerals and criticisms necessary to make digital goods.

The second lesson is that the White House seems poorly prepared for the consequences of the disturbances of this complex supply chain. Consider, say, the question of critical minerals.

This week Beijing Export controls imposed More than seven minerals of this type, after Trump imposed 145% of prices on China. It was not a surprise, for 15 years, China imposed similar borders in Japan in the middle of a fight.

Indeed, the 2010 move sparked such a shock in Japan that its government companies and agencies later created massive stocks of these minerals and developed alternative sources, Cut their dependence on China From 90% to 58%.

But the American entities apparently did not follow suit: in Vanderbilt, I was told that American companies (at best) have a few months of stock. Even the Pentagon seems poorly prepared. And while the White House is now looking for alternative sources – seabed or places like Ukraine – it will probably take a few years to materialize, as Center for Strategic International Studies warned this week. This means that America will be “on the rear foot in the predictable future,” adds the CSI.

Of course, Trump advisers insist that this challenge is temporary, because America will eventually create a local technological supply chain. It is the argument put forward by Trump acolytes such as Peter Navarro, Bob Lighthizer and Stephen Miran, and writers such as Ian Fletcher And the three generational trio of Jesse, Howard and Raymond Richman.

Indeed, if you want to understand the impetus behind the prices specific to the country recently announced by Trump, it is worth looking at the book of Richmans Balanced tradeand a 2011 later test. “Trump's formula to calculate the rate rates of specific countries is remarkably similar to our proposals”, ” said Jesse Richman, Who quotes personalities such as Warren Buffett and John Maynard Keynes as the intellectual ancestors of this tariff philosophy.

Maybe yes. But even if you kiss theories that lead such prices – that most of the Most Moderns, including myself, are not – it is deeply stupid to impose them without attentive preparations. Starting a trade war with China without storing critical minerals is a particularly obvious and stupid error.

So could it force Trump to withdraw? Maybe. Some Trump advisers are ideologists, but the president himself is (in) famous transactional.

This in itself highlights the third key lesson here: the White House seems to have seriously underestimated the lever effect of China in a trade war. After all, as the CSI notes, “China (a) prepared with a state of mind in wartime” for a long time. However, “the United States continues to operate under conditions in peacetime”, at least in the business world.

It changes now, quickly. And this means that investors should prepare for more technological supply shocks. Nvidia is only the attack edge of a potential storm.