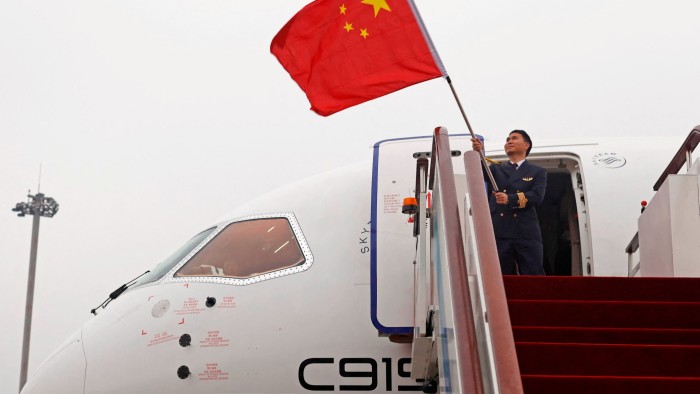

For years, Beijing has had great hopes that Comac's C919, China's first line of line in the country, could challenge the domination of the Boeing and Airbus aircraft market, showing China's technological autonomy and the progress made by its state -managed aircraft manufacturer.

But as the United States-China trade war degenerates, analysts warn that the high dependence of the C919 towards American suppliers for critical components could threaten plans to increase production and even to maintain passenger jets already in operation.

With the three major public airlines of China, the 17 C919 and the Comac are already expecting to build at least 30 more of the single plate aircraft This year, tensions between Washington and Beijing underline how Chinese companies can be highly dependent on American companies in their supply chains.

The C919, which made its first commercial flight in China in 2023, had 48 main suppliers of the United States, 26 in Europe and 14 from China, according to the analyst of Bank of America, Ron Epstein.

For most western aircraft components for the jet, there are no easily available domestic alternatives, according to analysts, which means that “can (stop) comac on its traces at any time,” said Richard Aboulafia, Managing Director of Aerodynamic Advisory.

One of the most crucial parts of the C919, its LEAP-1C engine, is built by CFM International, a joint venture between the American group Ge Aerospace and the French manufacturer Safran. While China has developed a national alternative, the CJ-1000A, it is still under test and is “not yet ready,” said Dan Taylor, head of the IBA aviation consulting council.

While CFM International continues to build the engines, including in France, added Taylor, the basic module is produced in Ohio. “If access to this was interrupted, it could become a major headache for Comac,” he said.

The other American suppliers for the C919 include Honeywell, Collins Aerospace, Crane Aerospace & Electronics and Parker Aerospace for various critical components and aviation systems. Honeywell did not respond to a request for comments, while Collins refused to specifically comment on his relationship with Comac.

“Unlike many other industries, the commercial aerospace industry did not depend on low -cost manufacturing in China,” said Epstein de Bofa in a note. “Most Chinese suppliers on the C919 are … no afflicted value subsystems such as engines, controls, aircraft or activation.”

Sash TUSA, an analyst in aerospace and defense based in the United Kingdom, said that even if the United States “have not (yet) said that they would not provide (components for the C919)-it could be the next step.” The current after-sales services, including the repair and maintenance medium of the C919 jets already in operation, will also have to count on American suppliers, according to aviation analysts.

For the moment, it is “likely that Comac has enough inventory to cover short -term deliveries,” said IBA. China has also already given pricing exemptions on American imports, including several products related to aviation. Safran said last week that China had granted Pricing exemptions for imports of certain aerospace parts.

But if the United States, at one point, decide to restrict exports of key components to China and “if China stops buying aircraft components in the United States, the C919 program is interrupted or dead,” said Epstein.

Comac studied the effects of pricing increases and sales were “not affected”, according to a person close to the company. The aircraft manufacturer did not respond to a request for comments.

Chinese public airlines would be the most affected if American-Chinese tensions were distributing comic production capacities. By 2031, Air China, China Eastern and China Southern Airlines should each operate fleets of at least 100 C919 planes, according to Mayur Patel, head of Asia for OAG aviation.

But Comac only delivered 13 C919 last year to Chinese airlines, and the aviation cabinet Cirium Ascend said that a single C919 had been delivered in the first three months of this year.

Analysts say that the slow production rate of Comac means that its aircraft cannot be Boeing or Airbus replacements in the foreseeable future. Beijing seemed to recognize this reality last Tuesday, the Ministry of Commerce saying that China was willing to support normal cooperation with American companies, just a few days after Chinese airlines have rejected Taking delivery of any new Boeing jets.

The prices and uncertainties concerning western supplies of critical components could also encourage the comac to rethink its priorities to deliver and pilot the C919 beyond China.

The airliner still lacks international certification, including the Federal Aviation Administration of the United States and the European aviation regulator, which limits Cormac's ability to fly outside China and its efforts to stimulate global sales. The European Aviation Security Agency recently said that it would take three to six years for the C919 to be approved.

But according to TUSA aerospace analyst, access to foreign markets may not be an important problem for the C919. “As long as it provides a large part of the Chinese domestic market, it is good demand in itself,” he said.

Additional reports from Claire Bushey to Chicago