Unlock the publisher's digest free

Roula Khalaf, editor -in -chief of the FT, selects her favorite stories in this weekly newsletter.

The leader of the largest diamond company in the world has expressed his confidence that the United States will remove prices on precious stones which, according to him, are “no advantage” for the country.

Al Cook, director general of De Beers, told Financial Times that there were “no American diamond extraction jobs to protect” and that the company had discussions with several governments on this subject.

The prices were “no advantage” in the United States and “would be purely a tax on American consumer consumer,” he said. “There would be no jobs created.”

The United States is the world's largest market for diamond jewelry, representing about half of global demand, but has no interior extraction or known commercial deposits of stones.

The prices announced last month by President Donald Trump launched the diamond industry in troubles and briefly brought the trade in jewels to a “dead end”, according to the market participants.

The World Diamond Council, a group of lobbies that represents industry, warned today that $ 117 billion in annual income as well as 200,000 American jobs in the jewelry sector would be at risk if the United States did not suppress stones.

“Diamond prices would work like a consumption tax, increasing the prices of engagement rings, birthday gifts and other jewelry, the group said in a statement on Monday that urged the White House to exempt the jewels of new import rights.

The diamonds entering the United States is subject to the price of 10% on all imported goods and face a variable tax based on the country which has been suspended for 90 days.

Many raw materials have been excluded from the prices, but diamonds were not – adding to the pain for an industry struggling with a slowdown in demand and competition from synthetic diamonds, which can be made to a fraction of the cost.

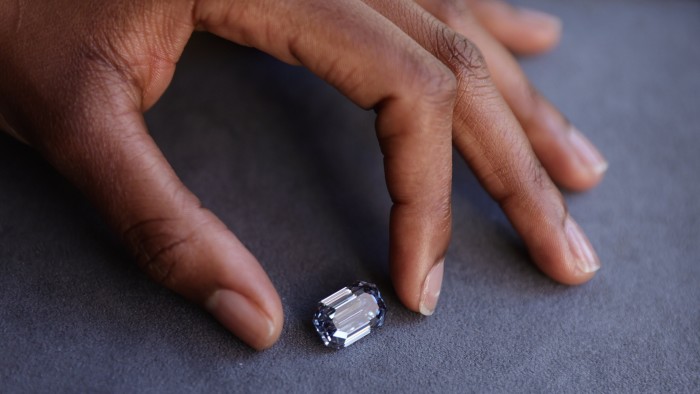

Because diamonds are so small and precious, they are often stolen worldwide in a complex supply chain that extends from mines in countries such as Botswana or Angola, to Polish centers in India, to jewelry stores in China or in the United States – which makes them very sensitive to commercial interruptions.

The lamentable market conditions and tariff disruptions occur at a particularly sensitive moment for De Beers, while he is preparing to be withdrawn from his parent company, Anglo American, listed in London, either by a sale or by a first public call to public.

Anglo should launch an official sales process for De Beers “very soon,” said Cook. The company is preparing simultaneously for an IPO which could take place at the start of next year, he added.

De Beers recorded a turnover in the first quarter of $ 520 million, or 44% below the same period a year earlier due to the drop in prices and sales volumes.

Anglo American twice Writes the value De De Beers in the past two years, winning a disability of $ 2.9 billion in the Diamond unit in February and a disability of $ 1.6 billion the previous year.

Cook admitted that the prices had “an impact” on the diamond industry, but said it was “not as drastic as possible”.

“People are sufficiently convinced that in the long term, diamonds will be exempt from prices,” he said.

“The United States has been fairly clear that the natural resources produced outside the United States are not tariff targets.”

Cook's comments occur after the White House gave land on prices by granting exemptions for articles such as smartphones and car components.

Positive noises of trade talks between the United States and India – the largest diamond polisher in the world – also suggests that a stay could be at hand.

A trade agreement between New Delhi and Washington could attenuate one of the key pinch points along the diamond supply chain, as India polite more than 90% of diamonds in the world and is a major exporter for the United States.