Unlock the publisher's digest free

Roula Khalaf, editor -in -chief of the FT, selects her favorite stories in this weekly newsletter.

American actions joined Friday, destroying the steep losses that followed the announcement of the “Liberation Day” by Donald Trump a month ago, after the labor market data exceeded expectations.

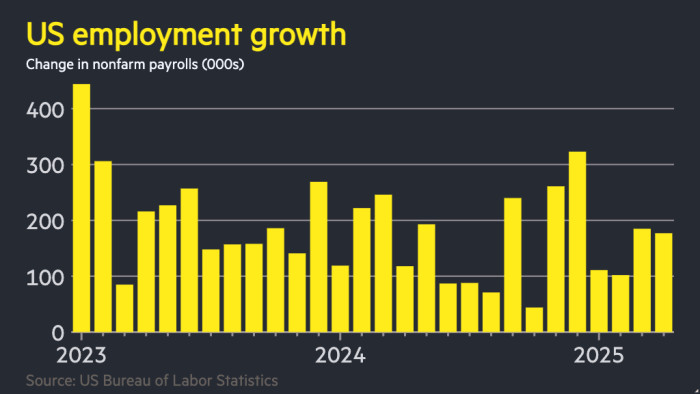

The 177,000 jobs Added in April, according to the Bureau of Labor Statistics, exceeded 135,000 predictions by economists questioned by Bloomberg, although the number marked a fall in the downward revision of 185,000 March.

The S&P 500 jumped up to 1.4% on Friday morning, exceeding it above April 2, when Trump unveiled his so-called “reciprocal rates”.

The Wall Street's reference sharing index had plunged up to 15% in several days of turbulent negotiation after the announcement of the American president, triggering a tumult on the global financial markets.

But global actions have since been widely restored, helped by signs of possible thaw in trade tensions, including comments from the Chinese Ministry of Commerce on Friday that Washington had recently expressed “the desire to engage in discussions” on the issue.

“This rally seems to expect that – with regard to prices – the worst has passed,” said Ajay Rajadhyaksha, World Research President in Barclays. But he added: “In fact, it's exactly the opposite. The worst has not yet manifested itself in the data. Nothing has yet been manifested in the data. ”

Despite the resumption of stock markets, the dollar remains 4% below its level of “Liberation Day”.

After the data on Friday jobs, the yield on two -year treasure bills, which follows the expectations of interest rates and goes reverse at prices, increased by 0.08 percentage points to 3.78% as the investors bet that the American federal reserve continues to borrow higher costs.

“People were afraid of a downward surprise that was not to come,” said Mike Riddell, fund manager at Fidelity International.

Traders continue to provide at least three interest rate drops this year, but the probability of a fourth decreases to around 30% compared to around 60% before job figures.

Goldman Sachs said that he had rejected his expectations of the drop in the following rate from June to July.

“The Fed should lower its rate !!!” Trump posted on his social network Truth shortly after the release of the data on jobs, because he praised “strong employment and many more good news”.

Friday's employment numbers intervened after mass layoffs of thousands of federal employees by the so-called Ministry of Elon Musk's Government.

Friday data said that the employment of the federal government has decreased by 9,000 in April and 26,000 since January.

The overall unemployment rate was unchanged at 4.2%.

Claudia Sahm, chief economist of New Century Advisors, said that even if Trump's economic policies were “anything but subtle”, their initial impact was “relatively low”.

She added that it would take time “to work on the system, which means that the Fed will wait”, and that all the cuts were probably later in the second half rather than during the central bank meetings in the next two months.

Official data of this week indicated the First fall in GDP for three years But was distorted by an increase in imports before Trump's commercial prices, the remaining domestic demand.

Many economists provide that homework will serve as an underlying growth in the second quarter of the year.

“Overall, this is an indication that the labor market has not yet deteriorated,” said Gennadiy Goldberg, head of American rates at TD Securities, about Friday employment data. “But investors are always nervous that another shoe falls. We just don't know when.”

Additional report by Ian Smith in London