Donald Trump's trade war with China has intensified the battle to control the critical mineral market which is essential in products ranging from electric vehicles to iPhones and military equipment – and underlined the dominant position of Beijing.

China's response to the US president's punitive prices was to introduce controls on the export of a group of elements in the rare land category, aroused fear in Western companies, such as American manufacturers, which are counting on them. Trump retaliated by ordering an investigation into the security risks posed by American dependence on imported critical minerals – a process that generally causes scanning prices.

The affirmation threatens to reduce the years of effort to develop complex but fragile supply chains in critical minerals that extend around the world, and the challenge encountered by the West to free itself from Chinese labor.

What are critical minerals and rare earths?

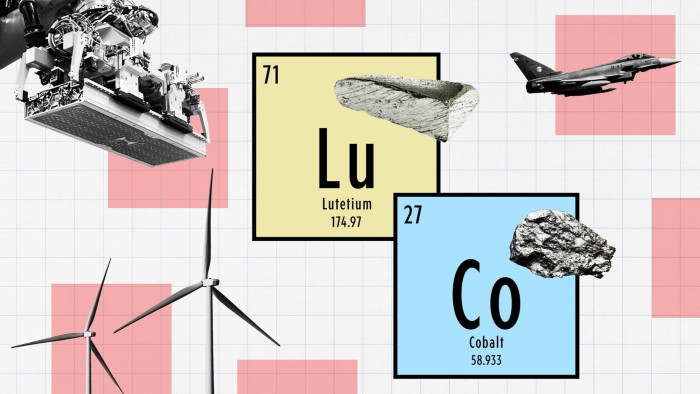

Critical minerals have traditionally referred to products such as Tin, Nickel and Cobalt which were vital for the defense sector.

But an expanding material basin is now labeled as critical because of their importance in a range of high -tech industries, in particular clean energy, semiconductors and other advanced technologies, and the higher risk of supply disturbances because extraction or treatment is dominated by a single country – in many cases, China.

The EU has appointed more than 30 due to their economic importance and their risk of supply, while Trump's decree applies to a wider list about 50, including zinc and lithium.

The rare earths such as dysprosium, terbium and yttrium are a group smaller by 17 elements which – despite their name – are quite abundant, although they are often difficult to extract because of their low concentrations. They also tend to be grouped together, which makes it difficult and expensive to separate one of the others.

The magnetic, luminescent and catalytic properties of rare earths make them essential for powerful magnets used in motors, wind turbines and electronics, as well as lasers used in missiles and catalytic converters.

Why are they so important?

Just as coal has contributed to underlie the British Empire and the United States has increased on supremacy on the basis of abundant fossil fuels, the battle to control the supply of critical minerals is a new border.

Modern technologies such as semiconductors, drones and electric vehicles are based on critical minerals, and domination in these sectors will increasingly define global economic and military superiority.

China's decision, which has spent years building its position on the market, to switch to a license system to control rare earth flows has the potential to be extremely disruptive, according to experts, although it is not clear how it will take place in practice.

Thomas Kruemmer, author of the rare blog Earth Observer, said that rare earths on the limited list of China were those where Beijing had an almost complete domination, chose “to have a maximum impact on the American military-industrial complex”.

A question, because the new license regime takes place is the extent of stocks held by Western countries and companies. Holding several years of inventory for critical minerals is not unknown because the quantities can be small.

Ionut Lazar, consultant of the raw goods analysis group, said that it would take two months for the effects of restrictions to feed users, by putting a range of hairstyle industries.

Where is China the most dominant?

China is by far the main actor through the critical mineral sector, but its grip is often the strongest on the so -called median – refining and treatment of metals – than on mining itself.

David Merriman, research director of the Blue Consultancy project, said Beijing had applied export restrictions on the special rare land that she was targeting because she had the “greatest control over the global supply of these elements”, which gives the potential of a maximum disturbance.

In addition to being a negotiation tactic in the climbing of the Sino-US trade war, this decision will help protect manufacturers of interior magnets in China while undergoing American competitiveness in electric vehicles, electronics and IT, said Merriman.

US Geological Survey said in March that China Driving production Of 30 of the 44 critical minerals, from arsenic to tungsten. In a previous study, he said that the materials supposed to have the highest risk of supply were gallium, vital for semiconductors and night vision glasses; Cobalt, an aerospace metal and battery; And the neodymium, a rare “light” land used in permanent magnets.

Sir Mick Davis, the former Xstrata chief who heads Vision Blue Resources, an investor of critical minerals, told a conference in Washington this month that Beijing had a strategic and competitive advantage because of his investments in treatment within his own borders.

“The West, Europe, the United States was sleeping behind the wheel while looking at this happening,” he said.

Who is still based on Beijing?

It depends on the mineral. In some cases, China is almost self -sufficient. For example, China has extracted more than three -quarters of the world graphite in 2023, the main material used in the anode of a battery.

But Beijing has also invested massively to secure supplies of mineral resources abroad, sometimes in exchange for investment in infrastructure.

It has strengthened its dependence on the neighboring Myanmar for strong rare earths, because domestic resources have fallen, but it still needs raw materials to enter its separation and refining factories.

South Africa provides precious metals such as platinum and rhodium used in catalytic converters and hydrogen fuel cells, led by Anglo American Platinum.

The Chinese groups Zijin Mining, Huayou Cobalt and CMOC also bought mines in Asia, Africa and Latin America which give lithium, nickel and cobalt, all important battery metals.

Can the United States secure alternative supplies?

The construction of the infrastructure of critical minerals to allow the United States to bypass China would take years, because companies should go through long research phases, allow processes and construction.

However, market disturbances and higher prices could end up being good for the diversification of supply chains, because new mines and processing facilities would be more investable at higher prices.

“It's not easy,” said Willis Thomas, head of the consultation branch of the raw goods analyst. “It will take two years to settle any really tight supply crisis.”

Financiers can hesitate to finance new projects, because China has the capacity to collapse prices by raising production and flooding the market. Another complication is that critical minerals are highly specialized and often made on customer specifications.

Experts believe that long -term government support mechanisms such as concessional funding, as well as stockings of raw materials from countries other than China, would be necessary to create an independent supply chain.

However, the probe of American critical minerals and the deterioration of relations with the nation with Canada – a mineral superpower – could thwart international efforts to diversify the supply chains of critical minerals, they warned.

“Much of what you see about Trump's policy is potentially self-deficit,” said Timothy Puko, director of basic products from Eurasia Group, a political risk consulting firm. “Especially the training effects of the way he manages the trade.”