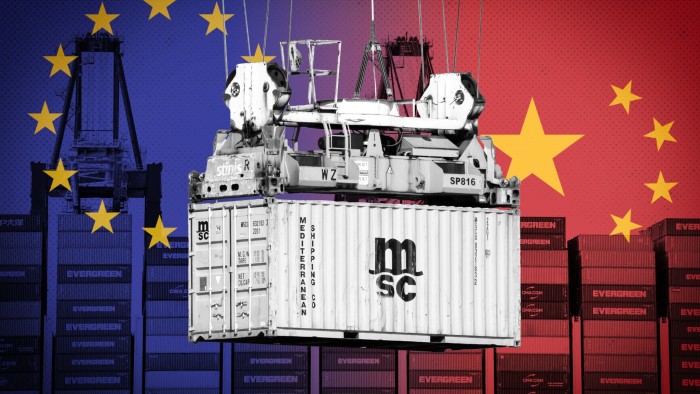

Chinese officials and companies are looking for a rapprochement with the EU in the midst of Donald Trump's business war, but the block remains deeply skeptical about becoming a dumping ground for the sheds of the United States.

Beijing seeks to deepen links with the largest commercial block in the world in the hope of finding alternative markets for its goods against the United States price. China has sent commercial delegations to European capitals in recent weeks and factories are exploring goods in the continent's markets.

EU leaders have also publicly expressed the need for greater cooperation, a strong contrast to the previous declarations indicating the need to “desire” the Beijing supply chains.

But reset in Me-China links should overcome deep differences in the enormous trade surpluses of China, the obstacles to access to its own market and to the tacit support of Beijing in the Russian War in Ukraine.

“It is time for China and Europe to start again,” Zhang Yansheng, principal researcher at China Academy of Macroeconomic Research Tank, told China.

Trump's pricing upheavals “give us the opportunity to rethink our commercial relationship-China should export more to Europe and import more,” he added.

Trump imposed new prices up to 145% on Chinese exports, threatening to reduce the flow of commerce between the two largest economies in the world. Beijing retaliated with 125% prices.

The EU, on the other hand, was affected by prices of 10%, which could increase to 20% if the talks could not respond to Washington's requests.

Trump's chaotic maneuvers have sparked a burst of awareness between Beijing and Brussels, as both parties are looking for a counterpoint in the United States.

Chinese chief Xi Jinping said to the Spanish Prime Minister Pedro Sánchez last week that China and the EU should “resist unilateral intimidation.”

Even the president of the European Commission, Ursula von der Leyen, who was a supporter of “disintegration”, said Chinese Prime Minister Li Qiang last week That both parties should work together to ensure “stability and predictability” for the global economy.

“The two need alternative markets as well as a feeling of stability,” said François Chimts, economist at the Mercator Institute for China Studies. “Tactically, an evolution towards more bilateral cooperation between these two economic heavyweights also widens their potential lever effect in all talks with the United States.”

The Chinese Ministry of Commerce has sent commercial delegations in recent weeks to events in Stockholm, Budapest, Oslo and Hanover to arouse the interest of investing in China, where foreign companies have complained about the obstacles to market access.

Peter Burnett, CEO of China-Britain Business Council, noted that Beijing had sent a large delegation to an event “Investing in China” this month at the Queen Elizabeth II Center in London. “For international affairs, China says you are welcome and we want you to do more,” he said.

Chinese manufacturers and exporters also turn to European market buyers for their goods. “We are working hard to extend our activities in Europe and elsewhere – and we are making progress,” said a director of Petpal, a large Chinese pet manufacturer.

American prices will accelerate the “trend of Chinese companies that globalize,” said Jarumir Cernik at CTP, a major investor in European industrial property. He added that the Chinese demand for factory and warehouse space in Europe increased.

But a European activity figure familiar with Chinese delegations said that EU governments did not have much to offer, because many companies were reluctant to invest in China. Last year, an investigation by the EU Chamber of Commerce in China revealed that More than a quarter of the respondents were pessimistic On their growth potential in China and 44% on their profitability.

Low domestic consumption in China has also created deflationary pressures, intensifying price competition and making the country a less attractive market for foreign companies.

Any relaxation should also overcome significant friction. The EU criticized China about its alliance with Russia and the support of the invasion of Ukraine by Moscow. Belgium is investigating Huawei, the Chinese telecommunications champion, for having allegedly united members of the European Parliament.

XI also plans to snub a marking 50 years of bilateral links, while forcing Von der Leyen and the president of the European Council António Costa to go to Beijing in July for a meeting which was to take place in Brussels.

But the Chinese chief will attend a victory day parade in Moscow marking 80 years since the end of the Second World War.

China exports to the block were more than double its imports last year, and EU leaders accused Beijing of cultivating industrial overcapacity to compensate for economic weaknesses at home, flooding the continent's markets with low-cost goods and undervaluation of the local industry.

Von der Leyen last month echoed Trump's concerns concerning trade deficits, saying that some countries “took an unjust advantage of current rules”.

The EU has opened business defense surveys on goods ranging from electric vehicles to plywood, some causing prices of more than 100%. Beijing retaliated with probes targeting pork, cognac and dairy products.

“Europe’s relations with Beijing have sealed new stocks due to growing commercial imbalances, China's support for Russia and an increase in Chinese cyberattacks across Europe,” said Noah Barkin of the Rhodium Group consulting company. “It is difficult, given this backdrop, to consider a kind of relaxation between Brussels and Beijing.”

But if commercial discussions with the United States fail to negotiate prices, the EU “could decide that even a bad agreement with Beijing is preferable to a two-forehead trade war with the United States and China,” added Barkin.

Leyen Recently said to the Financial Times That the EU “would take guarantees” against dumping, adding that Li had promised to take measures to support domestic consumption and soak up excess production.

China and the EU have also agreed to intensify dialogue and high -level negotiations to resolve samples from Chinese electric vehicles.

Beijing can count on certain German companies with a significant imprint in China to support closer links. A political document was disseminated among the representatives of German companies in China this week called on the government entering Berlin to “play a more active role” to support their commercial interests in the country.

The freight prices indicate the first signs of a commercial reorganization. The Ningbo containerized freight index has shown that rates of the American West Coast plunged 18% for the week until April 11 compared to the previous week, while the Mediterranean prices increased by 15%.

Zhang at the Macroeconomic Academy of Research said that there was a “big misunderstanding” last year between China and the EU, noting that a delegation he had attended had received a cool reception.

“(The Europeans) looked at China with a biased perspective, they wanted” deadlines “of the industrial and supply chains of China,” he said, although he conceded that the Chinese part “flexed our muscles too much”.

“China and Europe must reinstall itself,” he said.

Additional report by Nian Liu and Wenjie Ding in Beijing and Florian Müller in London. Visualization of data by Haohsiang Ko in Hong Kong