THE S&P 500 has dropped by 10% or more nine times since 2010, not to mention the current sale. However, the index distributed an average return of 18% during the year following the start date of these corrections. In fact, the market was higher in eight of the last nine instances.

Keep these yields above average – and with many actions that are now negotiated with newly reduced assessments – it looks like an ideal time to add to the actions. Here are three magnificent actions that are negotiated with evaluations once in a decade that I would be happy to buy right now.

Where to invest $ 1,000 now? Our team of analysts has just revealed what they believe 10 Best Actions To buy now. Continue “

Zoetis (NYSE: ZTS) is a large animal health care company offering more than 300 drugs, vaccines and other precision health products to deal with pets and livestock on a global scale.

Since his spin-off of Pfizer In 2013, Zoetis distributed a total annualized return of 15%, demonstrating the swinging potential on the market of what could look like a booming investment at first glance. However, after having experienced a boom focused on the pandemic which saw pets and visits by the subsequent veterinary clinic, the actions of the company decreased by 39% while things were normalizing.

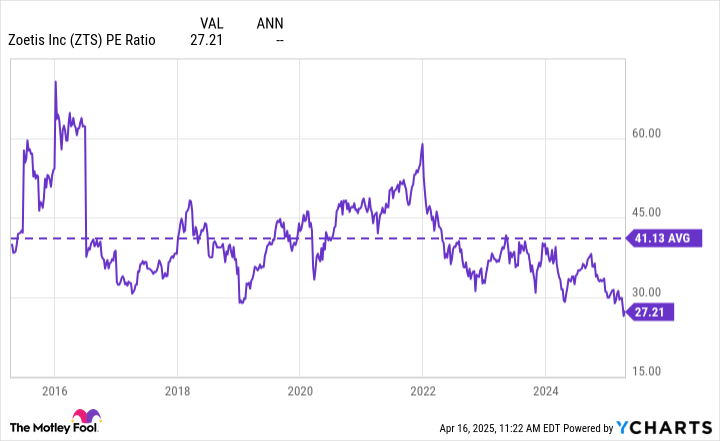

After this drop, however, Zoetis is now negotiated at a price / benefit ratio (p / e) of 27 – his lowest note in a decade.

Ratio zts pe data by Ycharts. PE ratio = price / benefit ratio.

Although the market is now more pessimistic about Zoetis actions than ever, real operations and the prospects of society seem stronger than ever. Zoetis increased income and adjusted profit per share by 11% and 17%, respectively, in 2024 and saw explosive growth in its new growth zone: helping osteoarthritis (OA) with pain in dogs and cats. Libéla (for dogs) and Solensia (for cats) increased sales by 80% and 20%, respectively, in 2024, while veterinarians continue to choose these OA pain products compared to traditional non-steroidal anti-inflammatory drugs which can have more side effects.

With 40% of dogs experiencing osteoarthritis pain at a given time in their lives and cats and dogs who are already living two years more than they were as recently as 2012, these drugs could play a key role in keeping our friends aging at ease.

A final good news for investors: dividend yield of 1.2% zoetis is its highest brand, and management has increased dividend payments by 18% in the last decade.

Regular growth, promising growth areas and a balloon dividend at a decade barrier assessment? I will continue to add to one of my most important participations.